With the US and China each forging their own space agreements with friendly states, perhaps common ground could be found in say, clearing up hazardous space debris

G7 nations and their Western allies have made clear their intent to ‘de-risk’ ties with China without fully decoupling. However, the inability to clearly define the term and differences of opinion between allies on how to proceed could render the efforts ineffective.

Whether it’s peace in Ukraine, Iran and North Korea’s nuclear ambitions, climate change or the Indo-Pacific, few topics will steer clear of China

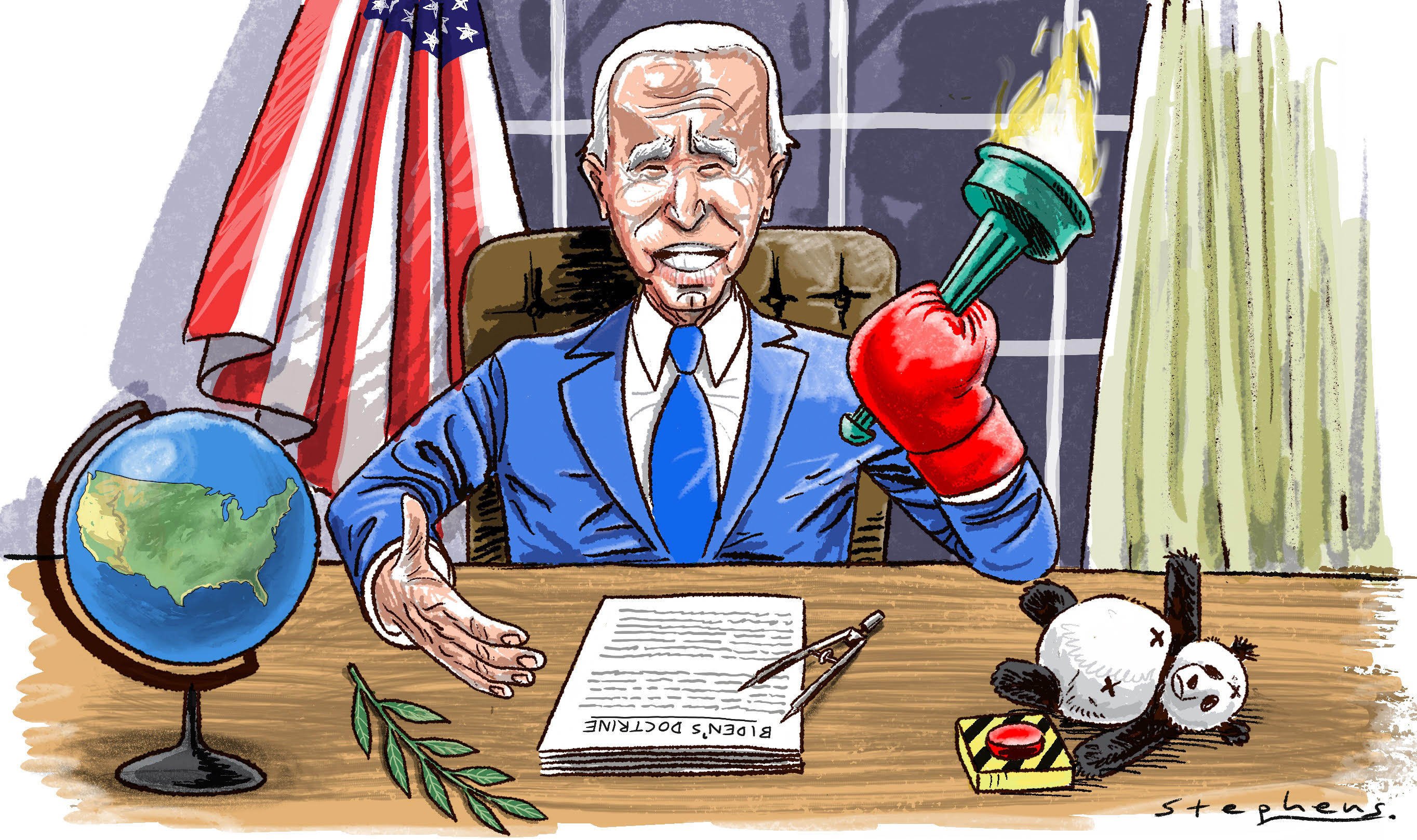

Despite its contradictions, US Treasury Secretary Janet Yellen’s speech in April affirmed at least four tenets of the American president’s doctrine. However, in the run-up to the 2024 election, the moorings of Biden’s policy approach may prove less deeply anchored than suggested now.

The World Bank and IMF have taken baby steps, including setting up a sovereign debt round table, but the plodding approach is likely to be overtaken by emergency action. This is especially as currency risks have yet to be addressed in debt restructuring plans.

China is starting its latest effort to drive a wedge between the US and Europe, but it is unlikely to change fundamental differences that impede warmer ties. Europe wants greater access to China’s markets, but domestic political concerns could keep European leaders from appearing too friendly with Beijing.

The wider impact of the US Fed’s rate raising campaign on bank-held investments is now hogging the headlines, but the question must be asked why regulators did not see Silicon Valley Bank’s demise coming.

The sitting US president is expected to run again next year, but he faces many challenges in forming a winning coalition and working with a divided Congress. Handling competition with China is high on Biden’s agenda but will only matter to voters if he can address the economy and ease concerns about his age.

By any measure, the debt crisis of developing economies and emerging markets is enormous, unsustainable and escalating even looking past geopolitical tensions. More incentives are needed to get reluctant creditors to deepen their commitments while improving capacity and decision-making in debtor nations.

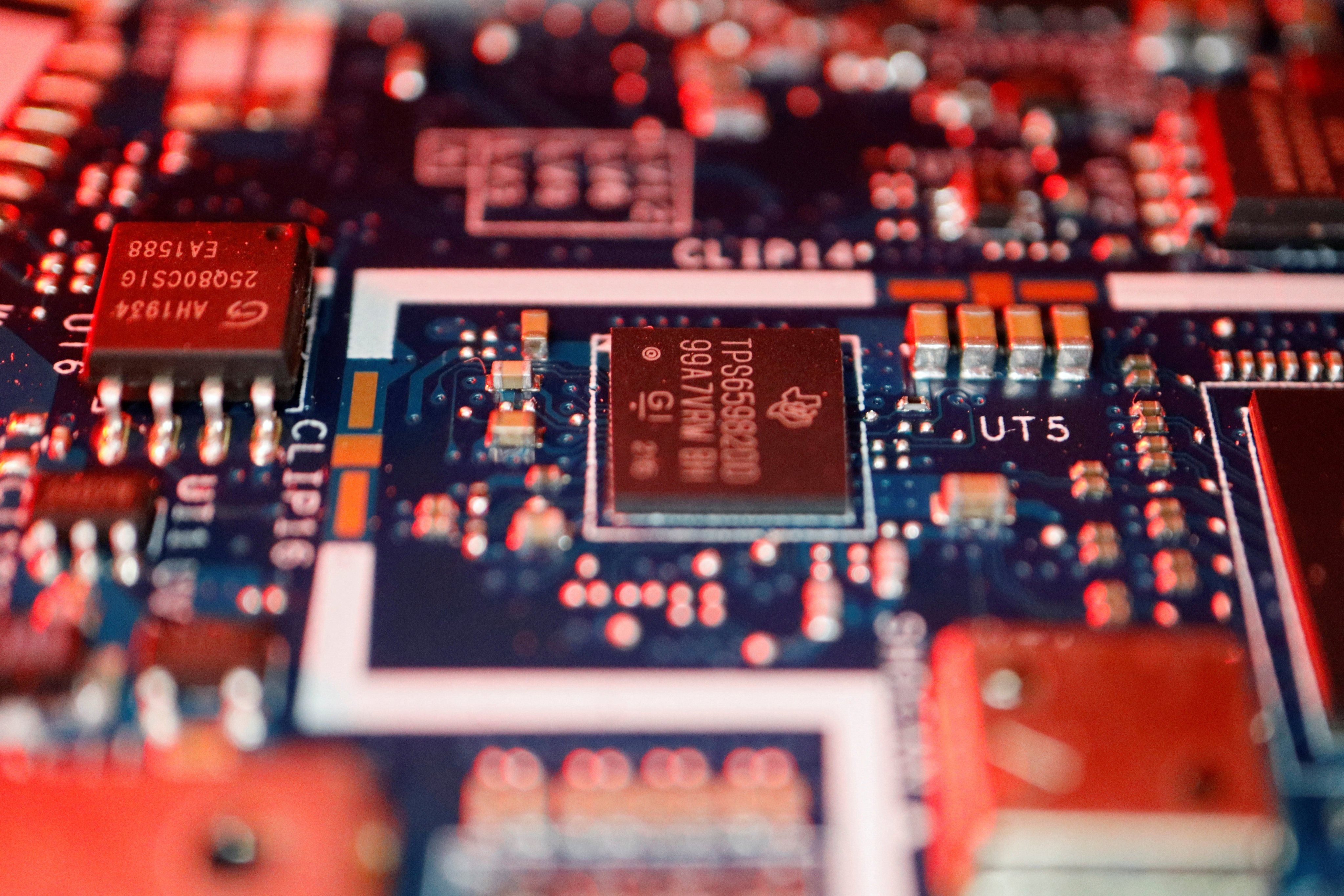

Europe is pushing back against US demands for it to stop selling semiconductor technology to China. Brussels’ insistence on setting its own trade terms with China is good news for Beijing – even if EU-China tensions persist elsewhere.

Optimism is starting to shine through as China pivots away from “zero Covid”, inflation eases and interest rate increases abate. Worrying trends such as ageing populations and high healthcare and energy costs remain, but there is reason to believe this optimism is more than wishful thinking.

Neo-mercantilism initiatives in China and the US, with their big investments and unprecedented trade restraints, will take years to show benefits. Yet much will change that could render this generation of semiconductor plants obsolete the day they open.

History shows that easy money inflates asset values. Everything eventually comes crashing down in a reversion to the mean. The global financial crisis was a textbook example, and its trajectory suggests a replay is likely soon.