Topic

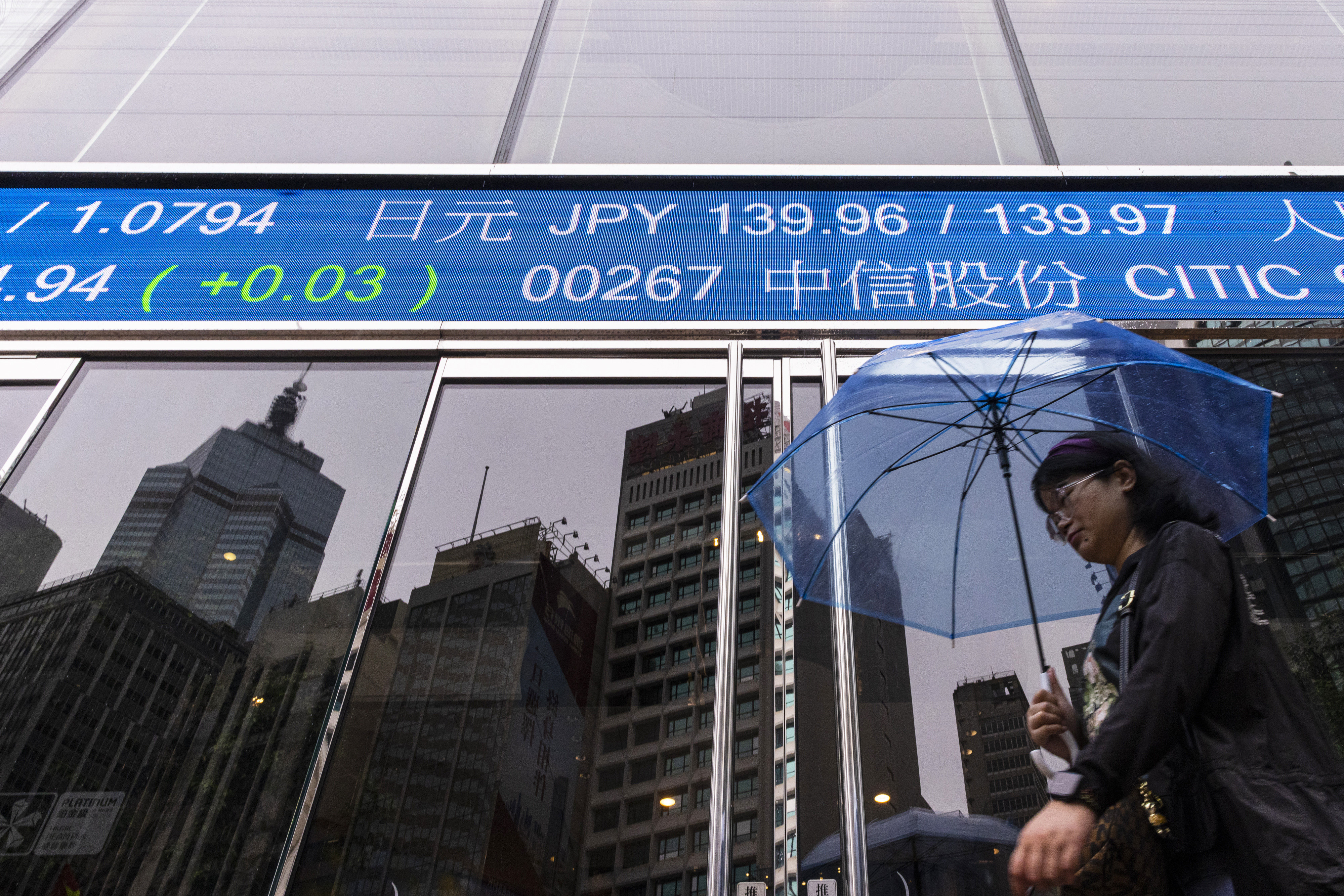

Latest news and analysis about the Hong Kong stock market, including market movements, policies, stock sales, and related exchange filings.

The new link between the exchanges in London and Shenzhen is also a boost for Hong Kong, as it will complement city’s role as one of the world’s most important financial hubs.

Plan will not only lift Hong Kong’s reputation as an international financial centre, but also enhance the liquidity of its bourse.

More than just bragging rights, the health of the capital market can also underscore the city’s status as a global financial hub.

The city will remain a crucial stepping stone for Chinese companies and investors to tap overseas funds, and provide the key gateway for global capital.

- China became a global IPO hotspot with a combined US$31.3 billion raised on the Shanghai, Shenzhen and Beijing exchanges in the six months to June

- The Chinese IPO market was rejuvenated after capital market reforms made it easier for companies to sell new shares

BYD advanced amid strong EV sales in mainland China, while Anta and sportswear makers also gained. Chip and AI firms struggled in the face of widening tech rivalry between China, the US and Europe.

China’s corporate earnings have run below potential in the past decade due to a deleveraging campaign driven by the belief excess stimulus promoted indebtedness and in the absence of a reflationary push, bonds will continue to outperform stocks, Alpine Macro said in a report.

Some of the top listed companies in Hong Kong resorted to massive share buy-backs in the first half of the year, taking advantage of a US$123 billion slump in market capitalisation.

Stocks in Hong Kong jump by the most in two weeks amid expectations efforts to dial down US-China tensions will boost the appeal of local assets.

Investment management behemoths BlackRock and Invesco have reiterated their positive views on regional laggards Chinese stocks and are betting that policy support will underpin strong second-half performance for the regional laggards, even as major investment banks slash their targets for key equity benchmarks.

Stocks erase an early advance, deepening the biggest quarterly loss since Beijing’s zero-Covid pivot. China is facing a confidence issue as investors wait for stronger policy responses, BlackRock says.

Can Chinese stocks still live up to bullish post-pandemic optimism? Analysts at HSBC Qianhai, Citigroup and UBS are the latest to trim and rein in their year-end targets.

Stocks dropped before a report suggesting Chinese manufacturing contracted in June, while Beijing avoids a bazooka-style stimulus. Major global central bankers said policy tightening may not be restrictive enough.

A new digital interface set to launch in October will cut the time between IPO pricing and commencement of trade from five business days to two, Hong Kong Exchanges and Clearing (HKEX) said in an announcement on Wednesday.

Stocks struggled to repeat Tuesday’s stellar rebound as chip makers came under pressure on concerns the US will curb exports to China. Daiwa slashed JD.com’s price-target after a call with the company.

Is there a case for China to flood its economy with stimulus? Beijing’s reluctance to pursue an ‘irrigation-style’ pump-priming is hurting the stock market, some strategists argue.

Alibaba, Tencent and Longfor helped overturn a five-day losing streak while New World jumped on the back of a debt and special dividend plan. Bets on China stimulus and earnings upgrades also aided sentiment.

Hong Kong’s third richest family, led by Henry Cheng Kar-shun, offers to take full control of NWS Holdings, including a big block held by New World Development, to help ease the latter’s debt burden.

Stocks drifted lower as more reports likely point to weakening momentum in China’s economic recovery. Global funds are favouring assets in India and Japan instead, according to Goldman Sachs.

Local stocks suffered the biggest weekly setback since mid-March, undoing the rally in the three preceding weeks. Concerns about global inflation and China’s economic slowdown eroded risk appetite.

Stocks slumped for a third day, erasing more than US$86 billion of value from the Hang Seng Index this week. China is behind the growth curve, BCA Research says, prompting analysts to cut their growth forecasts again.

The Hong Kong-traded shares of Chinese dual-listed companies have been closing the price gaps with their onshore peers, as distressed valuations and a pause in US interest rate hikes boost their appeal.

Stocks slide by the most in three weeks as China’s rate cuts fail to inspire market bulls. Alibaba Group declines from a two-month high on impending boardroom and management reshuffle.

Goldman lowered its 2023 growth projection for the Chinese economy to 5.4 per cent from 6 per cent, and UBS reduced its forecast to 5.2 per cent from 5.7 per cent, as the firms now expect mild stimulus support in the world’s second-largest economy.

Stocks retreated from a six-week high after another round of GDP forecast cuts by Goldman Sachs amid economic and policy struggles. Investors are growing impatient for a bigger dose of China stimulus, Saxo Markets says.

Chinese stocks are set to rally in the second half in a stimulus-fuelled bounce, a fund manager at William Blair Investment says. A valuation re-rating, coupled with earnings recovery, will underpin optimism.

Hong Kong stocks climb to the highest level in a month on expectations Beijing will offer more support to revive economic recovery. Some analysts caution against bets for aggressive stimulus measures.

There is a consistent message to Beijing from strategists and fund managers: more stimulus measures are needed to overcome deteriorating confidence in the economy and stock market outlook.

Chasing a basket of stocks with subdued price swings could be a successful strategy to ride out the market uncertainty in Hong Kong this year, analysts say.

The Hang Seng Index jumped to the highest level in a month after China cut a key lending rate to rejuvenate the economy. The Fed paused its rate-hike spree, while signalling more increases may be necessary this year.

Recent downgrades in targets for Chinese equities appear to be consistent with market sentiment. A Bank of America survey shows managers are losing confidence in China’s growth and stock returns.

A sluggish recovery in China’s economy is stoking concerns among strategists that the hyped-up policy stimulus will do little to shore up stock prices in Hong Kong, leaving the Federal Reserve to do the heavy lifting this week.

Stocks retreated from a three-week high amid concerns China’s speculated stimulus will be too little too late as Nomura warned more needed to be done to avert another dip in the economy.

Stocks advanced to the highest since May 22 after China injected more funds into the system, fuelling rate-cut hopes. Regional markets rallied as the odds on rate-hike pause in the US rose amid slower inflation.